From July 2020, Australians will receive their annual super statements, and returns to members are likely to be below those of recent years. Over the last financial year, Australian and international share markets have experienced periods of volatility - including the impact of the Coronavirus (COVID-19) pandemic. The combined effect of these periods has led to lower returns for super fund investments, compared to recent financial years – and this is most likely to be reflected in your annual super statement.

Volatility in share markets is a normal part of investing. It occurs for many reasons, such as responding to economic data, political events or company announcements.

Most of our super fund members are invested in what is called a ‘Lifestage fund’ that is based on our members’ decade of birth to help target both higher returns when members are younger, and safeguard their savings as they move towards retirement. This includes a diverse range of investments such as Australian and international shares, property, bonds and cash. So, the recent volatility experienced in these markets will most likely have affected your super balance and the returns you received last financial year.

While returns over the last last financial year may be lower than previous years given the volatile markets, it’s important to remember that super is a long-term investment.

Your super is designed to help you financially when you retire, so it’s important to take a long-term view rather than focusing only on short-term returns.

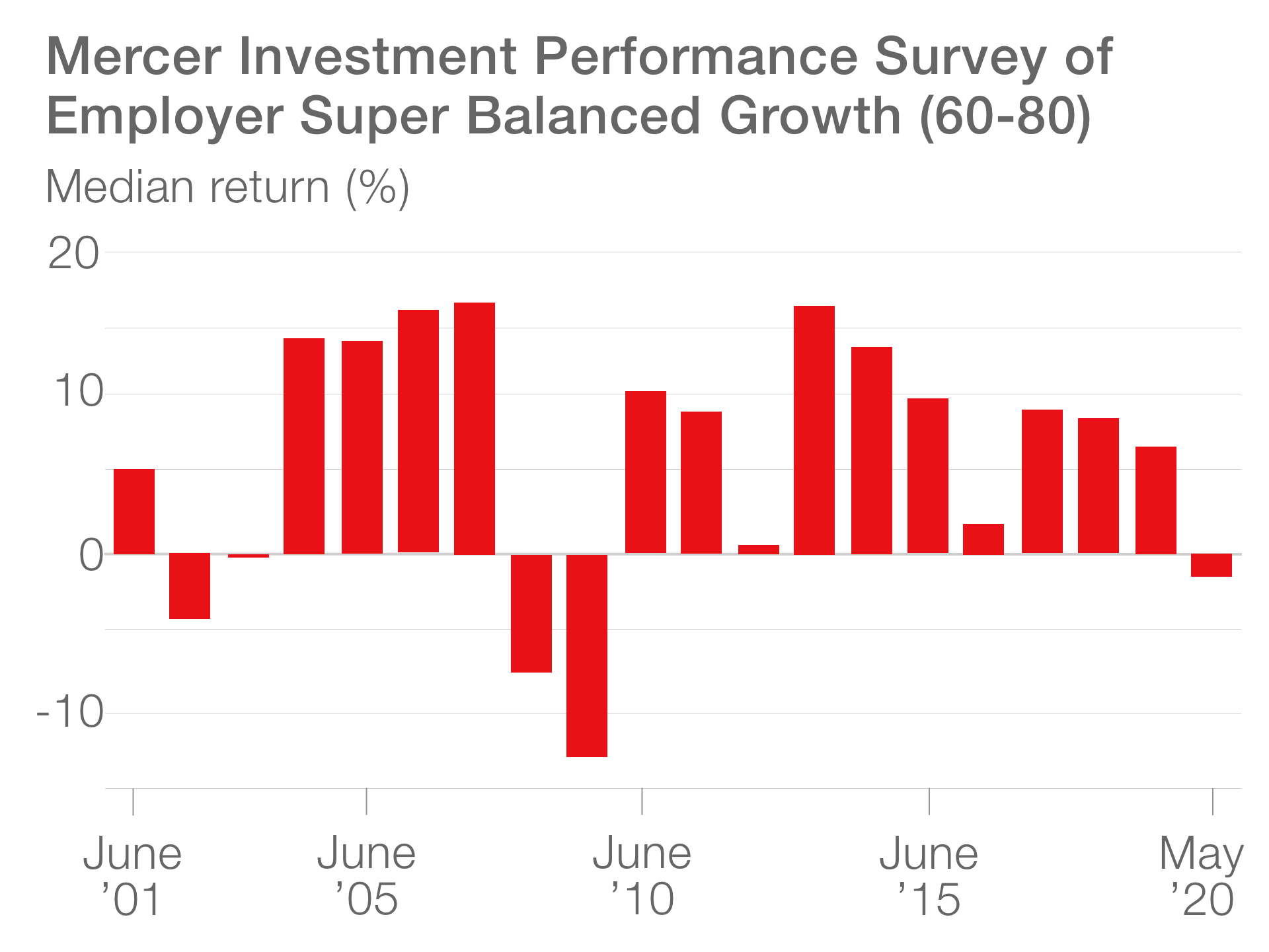

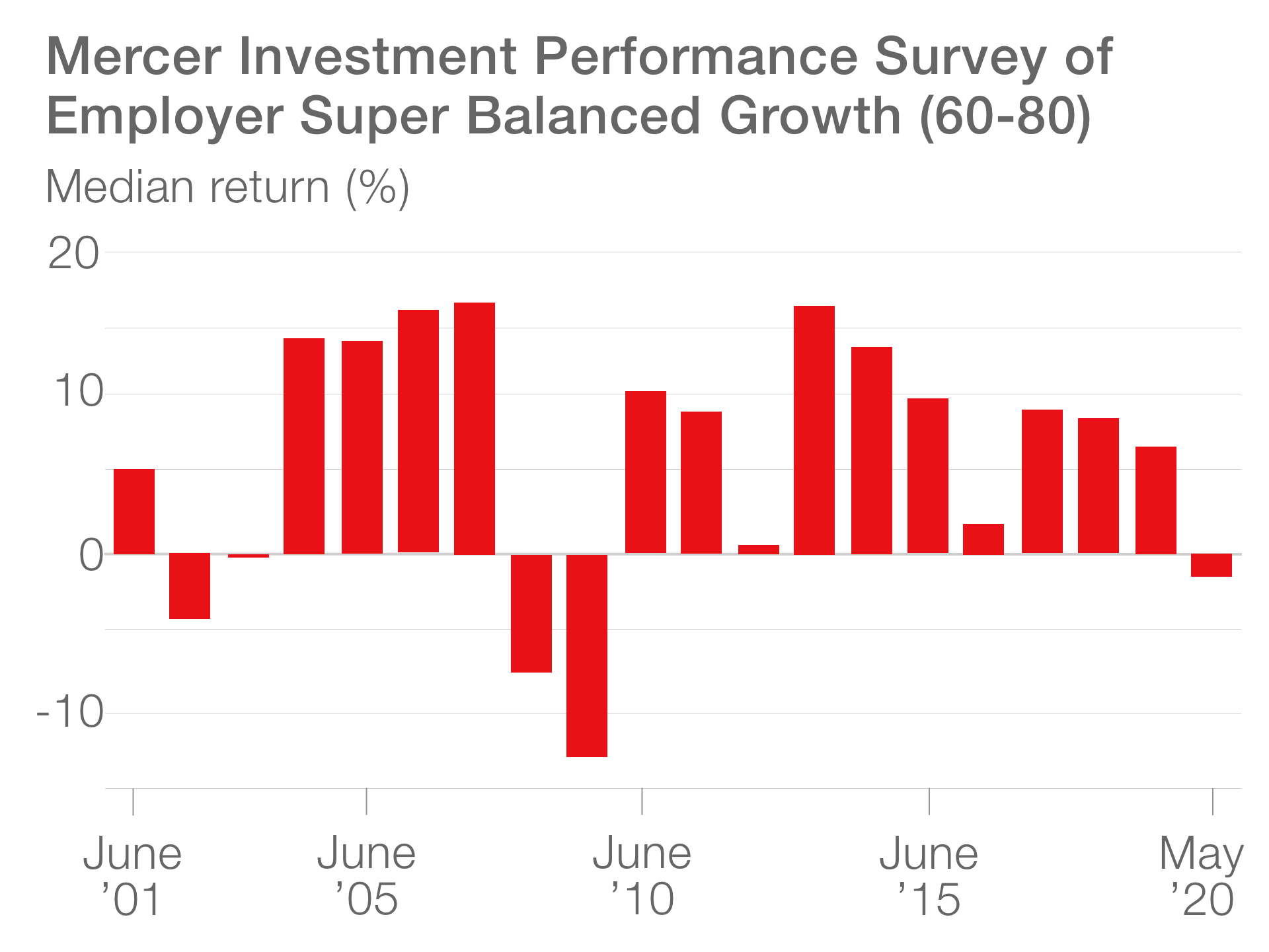

Over the last 20 financial years, from June 2001 and including up to May 2020, a typical ‘balanced’ (diversely invested) super fund in Australia has delivered a median return of 5.5% per annum net of fees and tax. Six of those years delivered above 10%, while only five years experienced negative returns (2002, 2003, 2008, 2009 and to May 2020).

Source: MercerInsight®. Median of the Employer Super Balanced Growth (60-80) Universe. Monthly Excess Return vs. Zero Benchmark in $A for reach financial year ending June 2019 including the 11 months to May 2020. Information for June 2020 was unavailable when this article was published.

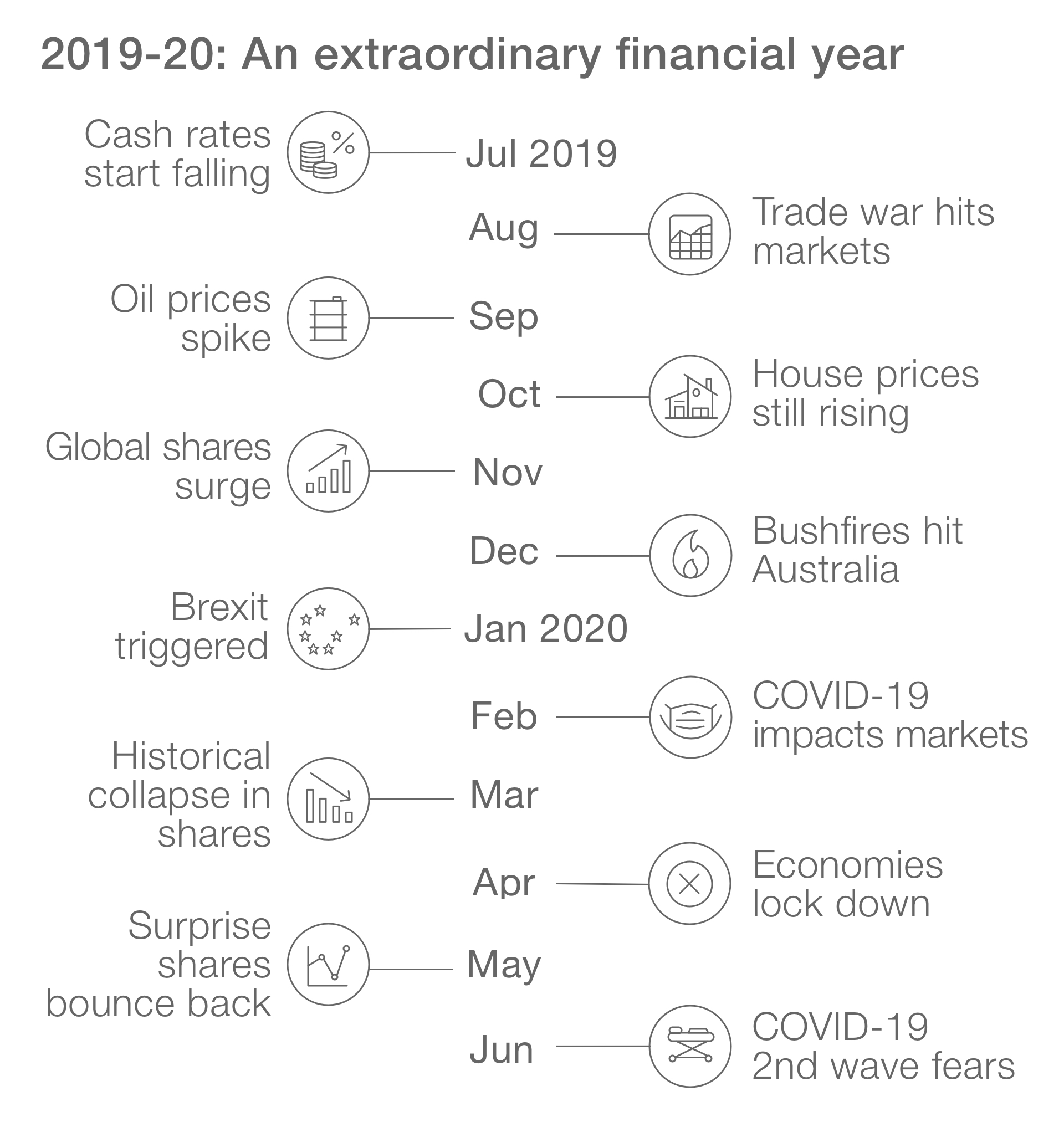

Financial year 2019/20 was quite a year! Markets across the world experienced unprecedented levels of volatility, rivalling the Great Depression and both World Wars.

Over the last financial year, we saw:

In the last few months, the world has entered unchartered territory. Economies have not just been suffering, they’ve been closed. Millions of people have been sick, and hundreds of thousands have succumbed to COVID-19.

Governments and central banks are continuing to roll out stimulus measures, to reduce the damage caused by the economic shutdown. The gradual lifting of containment measures has been seen as positive by the markets, although the long-term economic damage of the shutdown is still not known.

In Australia, our gross domestic product (GDP) fell in the first quarter of the financial year of 2020. A further decline in growth is expected in the second quarter of the financial year of 2020. This means we’ve entered our first technical recession in almost three decades.

While we’ve witnessed a strong recovery in equity markets from the March lows, supported by the benefits of low interest rates and the enormity of spending programs by governments around the world, there are still concerns over the short term. A rise in unemployment can result in lower productivity and economic growth, particularly if this reflects longer term structural changes in the economy. Countries also face the uncertainly of a possible ‘second wave’ of COVID-19 infections and its potential impacts.

Generally, over the long-term, shares and property continue to provide an opportunity to build long-term wealth. Particularly now, given the continuing low returns on offer from cash and traditional bonds.

As always, you can diversify your investments. Diversification is where you spread your investments across different asset types. It helps you ride out the ups and downs of financial markets, leaving you less exposed to a single economic event.

Your annual statement will help you understand how your super is invested, so please take the time to read through it. The closing balance represents a point in time – at 30 June 2020. It doesn’t reflect your potential investment returns over the long term – towards to your retirement and beyond. To view your current balance, log into your super account.

Remember:

For more information on how the COVID-19 pandemic affected super returns, please visit BT’s dedicated COVID-19 hub at bt.com.au/covid-19.

This document has been created by Westpac Financial Services Limited (ABN 20 000 241 127, AFSL 233716).

Past performance is not a reliable indicator of future performance and future performance is not guaranteed. You should not rely on past performance to make investment decisions.

Information contained herein has been obtained from a range of third-party sources. While the information is believed to be reliable, MercerInsight® (Mercer) has not sought to verify it independently. As such, Mercer makes no representations or warranties as to the accuracy of the information presented and takes no responsibility or liability (including for indirect, consequential or incidental damages), for any error, omission or inaccuracy in the data supplied by any third party.

It provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. This information has been prepared without taking account of your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. Projections given above are predicative in character.

Whilst every effort has been taken to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The results ultimately achieved may differ materially from these projections.

This document contains material provided by third parties derived from sources believed to be accurate at its issue date. While such material is published with necessary permission, Westpac Financial Services Limited does not accept any responsibility for the accuracy or completeness of or endorses any such material. Except where contrary to law, Westpac Financial Services Limited intends by this notice to exclude liability for this material.

Information current as at 23 July 2020. © Westpac Financial Services Limited 2020.